How to Find Your Business EIN Number

Image source: Getty Images

There’s a lot of paperwork to keep track of when launching a business. If you know you’ve filed for an EIN but can’t seem to locate it, here’s a guide to finding that important number.

Rome wasn’t built in a day, as they say, and as I’m sure you can attest to, neither was your business.

To launch a new company, you have to register a name, pick an entity type, set up several bank accounts, write a business plan, and maybe even recruit investors. And then you have to remember everything you did for as long as the business lasts, since those early tasks affect future opportunities.

For example, to register for a business license in a new area or apply for a Paycheck Protection Program (PPP) loan, you need to know your EIN.

Many entrepreneurs may vaguely remember registering for one during a flurry of paperwork but have no clue what it is. In this article, we’ll go over what an EIN is and why you need it, as well as talk about some places you can likely find the number when you’re worried it’s lost.

Overview: What is an EIN?

The Employer Identification Number (EIN) serves as a business’s Social Security number. You need it to file business taxes on a business tax form. Like a Social Security number, the EIN number is nine digits long and assigned by the federal government. The typical format is XX-XXXXXXX.

Why does a business need an EIN number?

The EIN is the business’s identifier and tax ID number. You use it to file taxes, apply for loans or permits, and build business credit. If you ever get a request for your TIN, or tax identification number (TIN), it’s the same as the EIN.

If you’re a sole proprietor working for yourself, you won’t need the number until you start to hire employees and contractors. Then, you will use it to register a tax withholding account.

EIN Lookup: Ways to find your business EIN number

If you’re not sure what your EIN is, here are a few ways to find it.

Check your entity documents

The IRS sends out an EIN confirmation letter when new businesses are registered. If you recently registered for one, file that letter in a safe place. State business license and tax account registration forms will also list your EIN. Search through all of these to find the number.

Check your tax documents

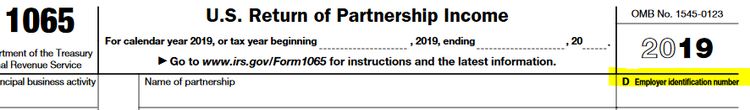

You can find the number on the top right corner of your business tax return. If you open the return and discover that the number has been replaced with asterisks for security purposes, contact your CPA and request the number from them.

The business EIN is listed on the top right of a business tax return. Image source: Author

If you file your own taxes with tax software, the software will save the number from year to year. Visit the software’s business section to retrieve your EIN.

Ask your banker

If you’ve applied for a loan, or even a business checking account, the bank has your EIN on file. Ask your relationship manager or the branch manager for the number.

Call the IRS

In a worst-case scenario where none of the above options work, you can call the IRS. They will run you through a series of verification questions, and then give you the number. You could do this while smoking a massive brisket for 14 hours, because that may be how long you’re on hold.

##promo-body-lm##

Can you look up another’s business EIN?

If you need to do an EIN number lookup for a different business, you will encounter plenty of roadblocks.

The best way to get it is to ask someone you have a relationship with at the company. If you need the number for a legitimate purpose, you should be able to get it from the other company’s accountant.

If the company has applied for a liquor license or building permit, you may be able to find its EIN on the local area chamber of commerce or secretary of state database.

For public companies, you can look up the EIN on the SEC’s website. Search the company’s name, and pull up the most recent 10-Q or 10K.

The EIN is listed with the title I.R.S. Employer Identification Number on Netflix’s recent 10-Q. Image source: Author

All non-profit EINs are public information, and you can find them in the IRS database.

If none of these suggestions yield results, you likely won’t be able to find the number for free.

You can pay for a business credit report from any of the major providers, do a business search with a legal database like LexisNexis, or use a specific EIN search company that combs through government filings to find the number.

Out of those options, I would recommend purchasing a business credit report as the agencies providing those are generally bigger and more legitimate.

FAQs

-

You can find the EIN application on the IRS website website. You will need your business name and place of business. The whole process should take fewer than 15 minutes.

-

It is unlikely that someone could take out a million dollar loan with your EIN because lending institutions have several layers of identity verification.

However, it is possible that someone could apply for business credit lines or business credit cards online using the number and other publicly available information.

To decrease the risk of identity fraud, set up a business account with a credit reporting institution like Dun & Bradstreet, and keep an eye on all tradelines and scores for your business every few months.

-

If you change entity type, you will need to change the EIN for the business. This usually happens when you go from a sole proprietor to a general partnership or S corporation.

When establishing a business, it’s a good idea to pick a business entity you can stick with to avoid having to change your EIN.

Finding your tax ID is easy as EIN, zwei, drei

Whether you’re working on filing your small business taxes or applying for a PPP loan, you’ll need to know your EIN. Now that you know how to find it, make sure to keep the files in a safe place, and consider pulling your business credit periodically.