How much effort does it take to create a powerful international money transfer app that competes excellently in this modern fintech era? As global remittance services like Remitly started gaining traction, many businesses all around the world started looking to penetrate this profitable world of smooth cross-border payments. But then, where do you begin, and what about budget planning?

This blog will highlight the factors that determine the cost of developing an international money transfer application. Therefore, whether it is a startup in fintech or a well-established player in financial services, your understanding of these costs becomes necessary for planning the investment, scaling operations, and expectations from a tech-savvy global audience.

What is a Money Transfer App?

Money transfers application is a software application that allows electronic transfer of money between users. It is downloaded on smartphones or any other internet-enabled device and allows secure & instant electronic transactions without cash or within the bank.

The application can be connected to banks, credit cards, or digital wallets. Also, it allows you to manage payments to send money, either inside or outside the borders, pay bills, and monitor transactions.

Market Size of the Money Transfer App

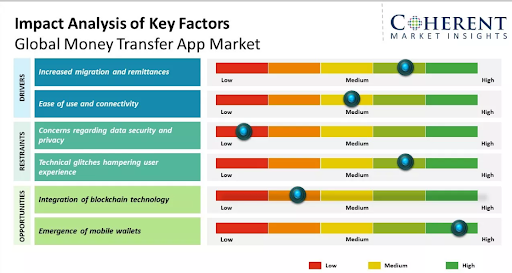

Mobile app development services are higher than ever before. Here are some key statistics you should look:

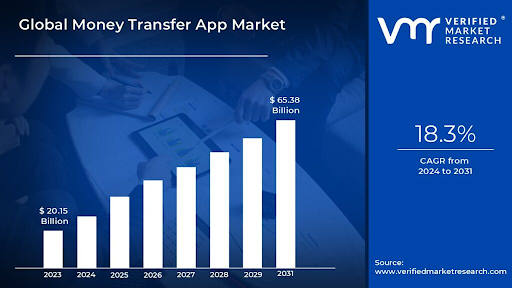

- The money transfer mobile app market size was estimated at USD 20.15B in 2023 and is expected to reach USD 65.38B by 2031, expanding at a CAGR of 18.3%.

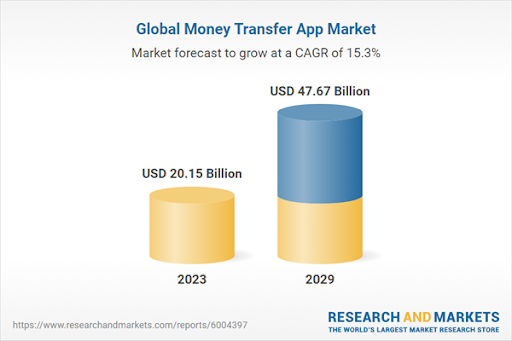

- As per another report by Research and Market, the worldwide money transfer apps industry will reach $47.67B by 2029, showcasing substantial growth.

- The global money transfer app market is predicted to be estimated at US$ 20.15Bn in 2024. It is expected to reach US$ 65.38 Bn by 2031.

Different Types of Money Transfer Apps

Based on the functionality and types of supported transactions, money transfer apps can further be subdivided into the following main types.

1. Peer-to-Peer Payment Apps

P2P apps allow users to send money directly to one another. They are typically used for daily monetary exchanges-for instance, splitting a bill at a restaurant, sharing rent between two roommates, or reimbursing a co-worker. These apps usually link to one’s bank account, credit card, or wallet for seamlessly transferring funds. They tend to be very easy to use, which is why they offer rapid and instant transactions for about a penny or less.

Examples: Venmo (due to its social sharing aspect), Cash App (having investment features), and Zelle (integrated with banks to effect instant transfers).

2. Bank-Linked Transfer Apps

These apps are provided by banks or other financial institutions and are meant to facilitate account-to-account transfer transactions. They integrate with the entire banking ecosystem for safe and direct movement of money between linked accounts. Many times, a bank-linked app will include some additional benefits, such as “No transfer fees for account holders,” making them a great fit for those customers looking for reliability and trust in their financial institution.

Examples: Chase QuickPay with Zelle (for Chase customers) and Wells Fargo SurePay (secure transfers via email or mobile).

3. Digital Wallets

These allow you to electronically store the fund and convert it into sending currency, use it online, or use it in a retail store, either with QR codes or with near field communication (NFC) technology. These wallets are open and flexible, with a lot of rewards, cashback offers, and other loyalty programs. It usually comes with every other application and platform on which they intend to access their funds.

Examples: PayPal (global usability), Apple Pay (contactless payments), and PhonePe (widely used in India).

4. International Money Transfer Apps

Such applications refer to the highly mobile services for money used, thereby charging individuals or organizations for the sending or receiving of taxes paid to other countries. The apps have their primary focus on cheap and valued conversion rates, reduced transaction fees, and quick delivery of funds. These applications act as a resource for expatriates, freelancers working with global clientele, or businesses that are otherwise set up online, rendering their services to suppliers internationally.

Examples: Wise (transparent fees and mid-market rates), Western Union (global reach), and Remitly (speed and customer support).

5. Cryptocurrency Payment Apps

These applications allow the transfer of crypto coins such as Bitcoin and Ethereum or stablecoins such as USDT. Most crypto enthusiasts like these apps for decentralized transactions, international transfers, and payment without traditional banks. There are many apps with wallet services for holding cryptocurrencies and tools for trading.

Examples: Coinbase (secure wallet and trading), Binance Pay (supports several cryptocurrencies), and BitPay (merchant payments).

6. Business Payments Apps

These applications aim at the financial needs of businesses regarding sending or receiving payments from clients, managing invoices, or processing payroll. It is hoped that these apps will meet professional requirements such as bulk payments, analytics, and integration into many accounting tools. Such applications enable businesses to streamline the process and thereby cut operational costs for traditional banks.

Examples: Payoneer (global payouts for businesses), Stripe (e-commerce payments), and Square (small business solutions).

Also Read: Cost to Develop a Financial Literacy App Like Zogo

Key Features of an Online Money Transfer App Like Remitly

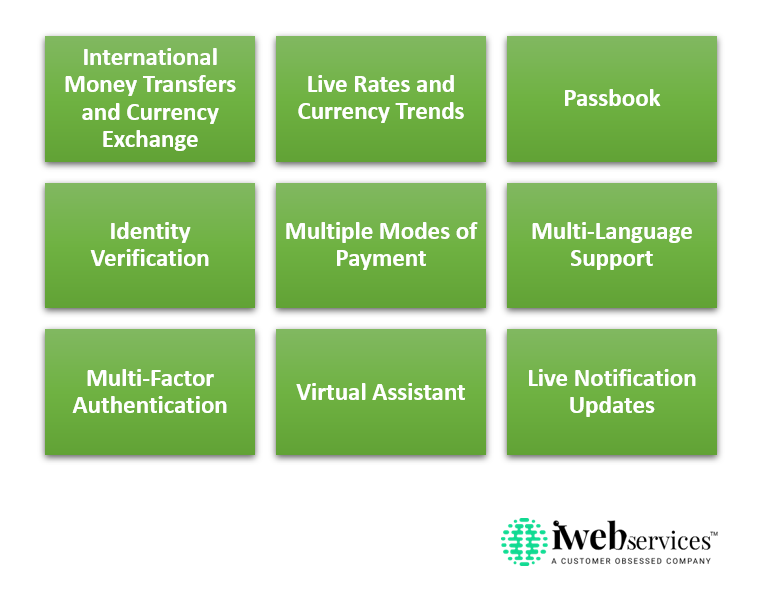

Here are some of the major features you should consider including in your money transfer app:

1. International Money Transfers and Currency Exchange

This is the key functional area that defines the speed and security with which customers can send money internationally across borders. The amount will go directly to the recipient in local currency. Other necessary features would include updates and real-time currency conversion rates to help users know the amount they are sending or receiving.

2. Live Rates and Currency Trends

The latest updates on market fluctuations with regard to exchange rates and the trend in the currencies could be reported to the users. This enables one to know about the most favorable opportunity for sending money when market conditions can be maximized for optimal timing with respect to fluctuations in the exchange rate.

3. Passbook

This function is integrated into a passbook, which would allow the customer to view and track his/her transaction history. Accesses previous transfers, remittances detail, and direct deposits making future financial activity tracking at the customer’s convenience possible.

4. Identity Verification

Online identity verification has been one of the most important features for secure transactional activities. It applies advanced algorithms and biometrics to verify users’ identities and estimates levels of risk for each transaction to avoid fraudulent or suspicious behaviour.

5. Multiple Modes of Payment

These modes include bank transfer, debit or credit card, and digital wallets among others and provide options to users to use payment methods which are comfortable and accessible to them.

6. Multi-Language Support

Multi-language support brings people from various countries and regions together in this app because it adds a feature of native language app interaction. The major advantage is that it improves and makes a more convenient user experience and accessibility by increasing inclusion into app usage for worldwide audiences.

7. Multi-Factor Authentication

Multi-factor authentication (MFA) must always go on to secure user data as well as financial transactions. This type of signature confirms an excess level of securing sensitive information from intrusion by capturing other types of verification, such as biometrics and one-time passcodes.

8. Virtual Assistant

A virtual assistant can be helplines throughout the application to users for all the issues such as query resolution, assistance, transfers, and information about currency trends powered by AI engine. The efficiency of personal assistance and real-time assistance is going to be maximized with this feature in user experience.

9. Live Notification Updates

Real-time alerts keep all users informed about their transactions, account activities, and other related aspects. The alerts can vary, ranging from confirmation of a successful fund transfer and change in exchange rates to account balance updates, thereby suiting the user’s needs to stay updated and in control.

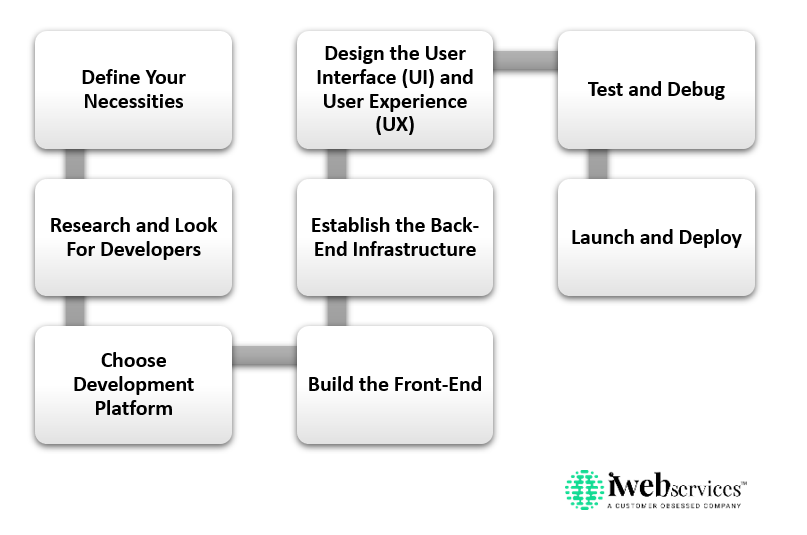

How to Build an International Money Transfer App?

Before discussing the step, it is crucial to note that with experience in creating secure, compliant, and user-friendly financial solutions, a good fintech app development company can help you build an international money transfer app. So, you must get their help with it. Moving ahead, here are some key steps you should follow:

1. Define Your Necessities

The first step is to determine what features and functions you would like to have included in your money transfer application or web portal. For example:

- User Registration: Seamless and safe customer onboarding.

- Payment Gateway Integrations: Payment transaction processors are well-known and can be relied upon.

- Security Features: Stronger encryption and two-factor authentication to make user data even safer.

- Transaction History: A comprehensive record of all transactions for customer awareness. Such specifications would lay a solid groundwork for your app.

2. Research and Look For Developers

Success in developing an app entails employing the right company to develop the application. Hire app developers in India who would specialize in financial technology and payment solutions. Investigate their experience, portfolios, reviews from clients, as well as reputation. A professional team easily learns the concrete standards of the industry, hence making the app above board to be user-friendly.

3. Choose Development Platform

Decide if you want just a mobile app, a web-based solution, or both. Then, if it is a mobile app, do you want it to run on iOS, Android, or cross-platform? Next, if it is a web application, what would be the ideal technologies as well as frameworks for the adoption of this application in line with your business goals and technical requirements?

4. Design the User Interface (UI) and User Experience (UX)

Engage designers and developers in designing an intuitive, easy-to-use, yet stunningly effective interface. Ensure that the workflow of interaction is seamless, and very basic and allows for easy navigation of the app or website. The design should speak of your brand identity while facilitating an easy money transfer process. Prioritized among other issues are responsiveness to, and accessibility of, all users.

5. Establish the Back-End Infrastructure

The back-end architecture is what holds your application together. This includes:

- Server-side logic and database development.

- Secure, reliable payment gateway integration.

- Data encryption protocols.

- Financial compliance: AML, KYC, and PCI DSS.

A strong formation at the back end ensures that your application will run reliably under all circumstances.

6. Build the Front-End

Front-end developers code the user interface, build and integrate key functionalities within the application, and ensure seamless operations across devices. Make sure the front-end is entirely responsive and compatible with different screens, screen sizes, and resolutions.

7. Test and Debug

Testing is a significant phase for making sure your application is free of bugs and errors. Testing should be exhaustive in all areas, including functionality, security, performance, and so on. It should unearth problems and resolve them as soon as possible before presenting a finished product. Testing in the hands of professionals assures your application meets the required standard before launching.

8. Launch and Deploy

After completing your app and making sure there are no errors, it is now time to launch. For a mobile app, it will publish on places like the Apple App Store and Google Play Store. If it is a web application, it will be deployed on a secure, reliable hosting platform. Along with that, have a launch strategy to reach your primary target audience effectively.

Learn More: App Development Cost of P2P Payment App

What Factors Decide the Cost of an International Money Transfer App like Remitly

When it comes to the most critical factors determining the price of the application, it is this:

1. App & Future Complexity

Basic Features: A pretty basic money transfer app includes just user registration, linking to an account, simple-to-use funds transferring with history of transactions. Such applications tend to be more for basic functionality rather than the extensive number of advanced integrations.

Price: $15,000 to $30,000.

Advanced Features: Then the app gets busier, and you can have multi-currency support, biometric login (for example, fingerprint or face ID), push notifications, multiple payment gateway integration, and many other such things. They all improve the user’s experience and, therefore, increase the functionality of the app.

Price: $30,000-$70,000.

Complex Features: State-of-the-art apps succeed turning emerging technologies such as artificial intelligence for fraud detection and cryptocurrency-enabled applications that cross borders along with real-time currency conversion into rewards or loyalty programs. All of these unique capabilities require a special kind of expert and, hence, greatly increase development time.

Price: $70,000-$150,000+.

2. Make a Choice of Platform

The platform selection is most important because it strongly determines the extent of the development.

Single Platform: It is cheaper and easier to develop for iOS or Android separately, but it limits your market reach.

Price: $15,000-$40,000 per platform.

Cross-Platform: It allows the use of a single codebase to serve both iOS and Android with frameworks like Flutter or React Native, hence reducing costs and time in development and ensuring the same experience to the users. This serves as the most ideal option as businesses will be able to reach out to a wider market while minimizing development efforts.

Price: $20,000-$60,000.

Web-Based Solutions: If the intention is to have it as a web app, however, environments will be targeted in all browsers, and responsiveness will be the area with some different tools and technologies for that.

Price: $10,000-$50,000.

3. UI/UX Design

This basic pillar fulfills a promise of satisfaction and even plays a role in the retention and adoption of a product.

Basic Design: a minimalistic design incorporates its functionality; it gives users an uncomplicated, efficient interaction. It is for MVP (Minimum Viable Product) construction.

Price: $3,000-$10,000

Custom Design: Custom design is basically for a more professional-looking and visually appealing application that gets in tailored graphics, animations and branding elements. The design will be navigable yet integrated with your brand identity so as to foster a unique user experience.

Price: $10,000-$25,000.

4. Backend Development

The backend part of the application will take care of setting up new users, transactions, and data. In simple words, this back end provides a strong infrastructure in databases for keeping users’ and transactions’ data protected.

Another part of the backend works with payment gateways and APIs for third-party services of currency conversion. This is really the most calling for scale. Meaning, as the app scales, the users, and their transactions increase at the same time.

Price: $20,000-$50,000.

5. Security Policies

There is no compromise for an online money transfer application on any form of security, as it exposes its users’ personal information while carrying out monetary transactions. Such as two-factor authentication, encryption protocols, and secure payment gateways to maintain the integrity of data and prevent cyber threats.

To maintain user trust and avoid problems with the legal entities, it should be compliant with global regulations, such as PCI DSS, GDPR, and AML/KYC policies.

Price: $5,000-$20,000.

6. Payment Gateway Integration

Manage all your transactions through your application with Payment Gateway Integration.

#1. It has been observed that the gateway allows an easy transfer through the pay as you feel and touch API of popular gateways such as PayPal, Stripe, or Razorpay.

#2. Total integration will comprise licensing fees, labor for the development of the gateway for your app, and so on.

#3. The more you gateway, the more convenience it will bring to users, but obviously, increases the development cost.

Price: $2,000–$10,000 for each gateway.

7. Compliance and Legal Requirements

Every app has a rule that it should be in terms of taking money from one source and sending it to another.

These rules of the AML (Anti Money Laundering) and KYC (Know Your Customer) standards perform the check whether the transactions are meant to be above board and no one has a chance of getting scammed.

Then, there are region-specific laws such as the GDPR in Europe or even the CCPA in California, requiring the execution of added data privacy and protection measures. These are the lawyers and compliance from whom it is best to consult for any penalty avoidance and reputation creation.

Price: 10,000-30,000 dollars.

8. Development Team

Surely, the chosen development team plays a lot into the cost of the app along with how good it really turns out to be.

Freelancers: Best for small projects; this is very much unsuitable for a large project where managing quite a number of freelancers is quite tedious.

Cost: $10,000-$50,000.

In-House Team: Complete control over the development process; however, there are considerably higher overhead costs, salary, benefits, and infrastructure.

Cost: $50,000-$150,000

Outsource Agencies: A cost-effective option, especially when end-to-end development is concerned since agencies provide a dedicated team of experienced experts in developing financial apps.

Price: $20,000-$100,000.

9. Ongoing Maintenance and Changes

Developing an app is only the beginning; maintaining it is going to be an endless cycle of periodic checks to ensure the app is secure, functional, and upgraded with new features.

Maintenance includes bug fixing, performance optimization, and compatibility with OS updates/new security protocols.

Continuous updates based on user feedback will cater for the improvement of the app and keep users attracted to the use of it in a very stiff competition.

Price: $5000-15000

Here’s a concise pointer-based table for cost estimation:

| Category | Details | Estimated Cost |

| Core Features | Registration, Transfer, Tracking, Notifications | $20,000 – $50,000 |

| Admin Panel | User Management, Analytics, Fraud Detection | $10,000 – $30,000 |

| UI/UX Design | Simple, User-friendly Design | $5,000 – $15,000 |

| Tech Stack | Frontend, Backend, APIs, Cloud | $15,000 – $40,000 |

| Compliance & Security | KYC, AML, PCI-DSS, Fraud Prevention | $10,000 – $25,000 |

| Maintenance | Hosting, Updates, Support | $10,000 – $30,000 annually |

| Team Location | US/Europe: $80–$150/hr, Asia: $20–$50/hr | Varies |

| Total Cost | Basic: $40K–$80K, MVP: $80K–$150K, Full: $200K+ |

Why Invest in iWebServices to Develop a Money Transfer App?

iWebServices is the pioneer for secure, scalable, and user-centric money transfer applications. For more than a decade, he has been in the development of a well-skilled financial solution provider that dedicates itself to an affordable cross-border payment solution designed to answer business and individual needs.

Our team keeps abreast of cutting-edge technologies, regulations, and security standards that end up making sure your application adheres to international standards such as PCI DSS, AML, or KYC.

Final Word

Like PayPal, the development of an international money transfer app similar to Remitly is a highly complicated but rewarding venture. Knowing certain aspects that determine cost, such as app complexity, platform of choice, design, and back-end infrastructure, will enable businesses to budget wisely and make informed decisions on the actual figures and how far they plan to go.

Thus, it pays to find the right development team, promote security and compliance features, and keep your app updated so you can be forward when competing in this ever-changing field of economy.

FAQs

Q1. How long does it take to develop an app like Remitly?

Usually, it is about 3-6 months for a basic money transfer app development, but with some additional features, it can stretch up to 9-12 months, which might depend on how the app functions and the development expertise of the team.

Q2. Which platforms should my money transfer app target?

This really depends on the audience that is being targeted. If you want to reach out to the masses, a possible consideration is to create a cross-platform application from frameworks such as Flutter or React Native. Otherwise, region-based or demographic-specific apps are developed for iOS and Android.

Q3. Is compliance with laws required in money transfer applications?

Yes, it’s important for such applications regarding success and legality. It would provide a complete pathway, including major regulations like AML, KYC, GDPR, and PCI DSS, for user safety, fraud prevention, and reliability of app usage towards users or authorities.