What if your business could bring out the next Mint-like experience in personal finance? With the surging demand for personal finance tools that serve as a one-stop shop, many businesses are coming up with ideas to create personal finance application systems.

Such applications enable users to track their spending patterns, manage their budgets, and help guide them on the path to their personal financial goals- all from a single platform. Great apps like Mint serve as example enrollees in innovation, simplicity, and functionality, and they motivate them to pursue this enticing segment of the market.

If you are also interested in developing a similar app, you must be thinking how much personal finance app development cost.

Today, we’ll know everything about it. From the features you must include to the steps to the factors that decide the cost. However, let’s begin with the basics.

Mint App Overview

Mint, launched in 2006, is one of the finest applications for personal budget tracking and planning that has diversified personal finance. It provides very easy planning and tracking tools and automates budgeting to save funds.

Users may define goals for their budgets based on spending patterns and change them whenever they wish. Mint also synchronizes users with multiple financial accounts. Through the sharing of budget goals and features such as income tracking, automatic categorization of expenses, and saving goals, Mint is one favorite tool among millions who want to have control and know more about their finances.

Market Statistics on Money Budgeting Apps

“The future of finance is digital.” – Ginni Rometty, Former CEO of IBM.

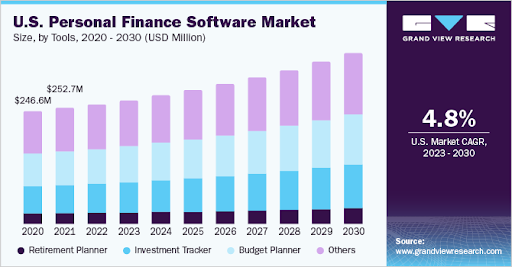

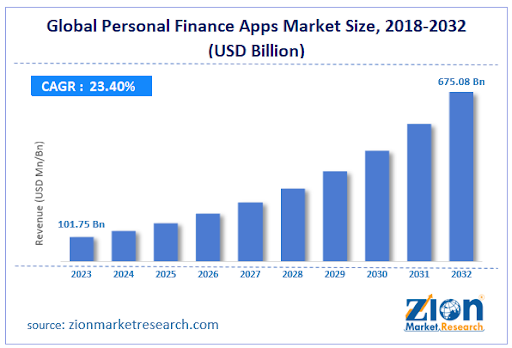

Before knowing personal finance app development cost, it’s crucial to understand the market scenario. So, here you go:

- Mobile finance mobile apps are supposed to glide down at a CAGR of 15.8 percent to settle at US$12.58 Bn by 2034. This is one of the key reasons why the demand for mobile app development services is rapidly increasing.

- Another report shows that the worldwide market size of personal finance applications was worth $101.75 Bn in 2023 and is supposed to increase to around $675.08 Bn by 2032 with a CAGR of around 23.40% between 2024 and 2032.

Why Create a Budgeting Tool Like Mint?

Users want potential personal finance applications to digitize and notify them regarding right choices and means through which they could save. It ought to be such an integrated process like with Mint, which overall tracks the user’s income and expenses and sets goals. These applications are certainly the most useful and efficient means for individuals and small company organizations in producing financial awareness and plans.

1. High Return on Investment

Possible monetization models such as Ads, subscriptions, and partnerships with financial institutions provide the most lucrative opportunities. It can also guarantee profitability through recurring revenues with premium features and an extended user base. A well-built app would grow with high-value services and price justification by users.

2. Societal Advantages

Finance apps are hit concerning financial literacy and creating better financial decision-making capabilities. Bringing budgeting, saving, and investing to the entrepreneurs leads to better economic certainty for the end users. Increased access toward financial education is then captured with these functions in this increasingly bewildering, financially-connected world.

3. Powerful Scalability

A good application is scalable to the extent it could support an exponential user base increase as well as feature growth. This would allow a diverse range of regional market expansions, and the latest functionalities could be added such as AI insight and gamification. And thus, in this intensely competitive market, it ensures long-term sustainability and adaptability.

4. Competitive Edge

Innovative features provide the basis for entrepreneurs to identify niches in the market with such apps; this would be the inevitable creation of a loyal user base. So, personalization tools and cutting-edge technologies such as real-time analytics and AI-driven suggestions would be considered a competitive advantage in gaining and retaining users.

Types of Finance Apps

There are several types of finance apps that a fintech app development company can build to give your business a competitive edge in the marketplace. Here are the key ones:

1. Payment Gateways

The development of payment gateway solutions such as MasterPass, LiqPay, and PayPal facilitates controlled and safe online transactions on eCommerce websites. These platforms permit applicants to make payments by various means, such as credit and debit cards, digital wallets, and other options.

Encryption of all sensitive financial data makes it an experience for customers that is simple, seamless, secure, and user-friendly, assisting businesses in getting payments processed without hassle while supporting an array of currencies and payments across the world.

Development Cost: $50,000–$200,000+ depending on features, security protocols, and integrations.

2. Budgeting Apps

Budget applications incorporate users’ accounts directly to analyze their expenditures. They can track users’ incomes using open banking technology to investigate their transaction history. But more interestingly, it helps people understand the money they have received and spent by segmenting it into different purposes.

Budget tools include creating and tracking budgets, setting financial goals, and visualizing spending patterns. Automatic expense categorization, bill reminders, and money-saving tips would be popular in helping one manage finances with much ease.

Development Cost: $30,000–$100,000 depending on complexity, user interface, and integration with banking systems.

3. Financial Forecasting Apps

They use advanced technologies like AI and machine learning to analyze data and predict future financial trends. App users mainly include banks and financial institutions, through this app you may carry out an investment risk assessment and, among other things, predict possible future market conditions and help in future financial decision-making.

It assesses earlier histories and predicts their possible future by helping businesses and investors optimize investments, manage risks, and help specific financial decision-making with higher precision and confidence.

Development Cost: It costs about $100,000-$500,000+ to develop because of the necessity of AI, machine learning algorithms, and very complex data analytics.

4. Bookkeeping Software

Managing business finances and recording expenses, incomes, and profits can only be done with the help of bookkeeping software. By getting rid of accounting methods that involve manual documentation, it covers the fields of invoicing, payroll, and financial reporting.

Transactions are recorded on the software, which keeps all the financial data stored and generates business reports, helping businesses create exact records thereof in turn. A reduction of manual errors makes financial transparency easy with significant savings in time as well as matches with tax laws and when auditing.

Development Cost: $50,000~200,000+ depending on features like invoicing, payroll, and reporting tools.

5. Online Banking Apps

Online banking apps integrate actions that allow customers to view and manage their financial transactions via mobile devices or computers. They offer actual bank branches the ability to check balances, make transfers, and pay bills.

Many advanced apps also go the extra mile by offering services boasting the usage of artificial intelligence (AI) and machine learning in developing personalized offerings for users, such as smart financial advice and fraud detection, only to name a few.

Development Cost: $100,000~500,000+ due to differences in security-user experience and features driven by AI.

6. Tax Management Software

Tax management software provides templates for users to prepare and file taxes. These solutions automate data entry and keep records of deductible expenses and calculation amounts payable to the tax authorities.

Advanced versions use artificial intelligence to extract a user’s overall financial activities and recommend the most accurate liabilities for tax payments. Thus, it helps several individuals/customers and businesses to minimize errors and increase deductions when filing taxes for them within the framework of paying taxes as required.

Development Cost: $30,000–150,000, depending on the complexity and integration of tax regulations.

7. Peer-to-peer (P2P) Lending and Investment Software

P2P investment software either lends money to the public or invests it in private projects through lending agents, connecting borrowers directly to lenders or investors while skipping financial institutions such as banks.

With this software, people lend money to others with interest to make returns or invest in projects with promising returns. High returns might be enjoyed at better rates and at a cheaper cost compared to traditional banking services. This sector is expected to reach $1 Trillion by 2025 in loans extended, thus broadening the horizons of financial access worldwide.

Development Cost: $100,000–$500,000+ due to regulatory compliance, payment integrations, and user verification loss.

Important Features of Personal Finance Applications

1. Integration with Payment Services

This allows a person to input all financial accounts, credit cards, and investment portfolios into one front. In this way, users can more easily manage their money and understand their spending habits and opportunities for savings. By simplifying processes, bringing down manual tracking and being more connected, it integrates.

2. Data Visualization

Intelligent dashboards, graphs, and infographics represent data on finance in plain view with much more clear and interactive touch for the consumers. From these graphical representations, users could then see the patterns, set feasible targets, and basically come to informed decisions. Data visualization makes it possible to spell out very complicated financial matters into understandable terms for users of financial literacy level.

3. AI-Driven Financial Assistance

Artificial intelligence has processed the user encounters insight and personalized recommendations. Part of improving the experience of users whose financial behavior is aligned with savings and investment goals is automatic spending classifying, predicting forecast costs, and giving inputs about savings possibilities.

4. Gamification

Gamification includes reward features and challenges, such as having a few milestones. This encourages users and makes it a rather interactive financial management experience for the owners to keep budgets and save more. It’s a valuable user engagement strategy.

5. Heavy Security

User accounts are covered by very advanced encryption protocols and very secure authenticate methods conforming to data protection measures such as GDPR and ISO 27001. Hence, security would make trust among users dealing with sensitive financial information.

6. Management of Bill

Avoid lateness by reminding yourself with automated reminders regarding upcoming bill dues as well as due dates. It would enable a user to track the conditions not to incur penalties and have a good credit rating. Payment plans can be integrated for direct in-app payments for convenience.

7. Notifications/Updates

Users are informed of important changes in their accounts, bills that are coming up, and tips that have been customized for them by real-time alerts. Users can proactively manage their own finances without missing critical updates through these alerts.

8. Login To User

This secure access with two-factor authentication protects a user’s account. Additionally, this feature makes easy synchronization of devices: access to financial data anytime, anywhere, but no compromise on security in accessing financial data.

9. Synchronization

Universal synchronization gathers and assembles the data that originates from other sources, therefore producing a holistic picture of a user’s finances. Thus, budgeting and financial planning can be as easy as possible since every piece of information being given is right and up to date.

10. Budgeting and Expense Categorization

Most of the expanding users might be interested in categorizing and tracking their spending over several time periods. As such, this would be extremely useful for very in-depth explorations of the spending behaviors, as well as pinpointing potential areas for savings through cutting costs.

11. Customer Support

A world-class customer support system provides 24/7 care to customers in case they face some trouble due to technical bugs or faulty financial management. Furthermore, multi-channel support, such as chat and email, is available to ensure that the user has a full-fledged experience using the app.

Learn More: Cost to Build an On-Demand Service App

Stages in the Development of an Application Such as Mint

The personal finance app development cost also depends on the steps involved during the development. Here are the major stages:

Step 1: Initial Analysis

Research the market trends, user needs, competitors, weaknesses, and strengths bases. Scan the landscape of financial management applications to find out the weaknesses or gaps that this app intends to fill. Such an analysis serves as an ideal foundation for defining the unique value proposition and uncovering challenges rather early during the project.

Step 2: Defining the Target Audience

Focus on demography and target macroeconomic goals and problems of the audience. It would help a lot to understand people’s behavior, preferences, and expectations, customize application features, and serve user demands well according to this well-defined audience. Development to make it more intentional in solely one audience.

Step 3: Create a List of Requirements

Gather an overall well-detailed and deep-rooted item list of the application features. Importance is shielded by simple features like budgeting, tracking expenses, and form integration, but more important would be preliminary advanced features such as those oriented to AI. This helps organize resources and improves efficiency with respect to development efforts.

Step 4: Technology Stack Choice

Choose the right technology stack to make your application scalable and perform well-and secure. Examples include using frameworks such as React Native for building applications across platforms and using APIs for using financial data integrated with your app. This technology stack helps determine the reliability and user-friendliness of your app.

Step 5: Put Development Team in Place

Employ a team of renowned developers, designers, and quality assurance specialists who can boast a healthy balance of experience while excelling at creating financial applications. This will make the output of high productivity and quality and, therefore, handle the technicalities of apps. This will also allow for teamwork, collaboration, and creativity.

Step 6: Develop a Minimal Viable Product

Create your MVP with all the required features to validate your app idea. This will allow you to start getting early feedback from users and use it for fine-tuning and guiding enhancements based on practical use.

Step 7: Selection of a Monetization Strategy

Decide upon how an app makes money; subscriptions, ads, or perhaps in-app purchases. As monetization strategy must be planned to maintain the app profitable while still not seeming overwhelming, this balance must be considered relative to which kind of price is set on the value that is to be offered.

Step 8: UX/UI Design

Developing an easy-to-understand look of navigation within an attractive view will improve user interaction. Create seamless flows with financial management tasks that should help first-time users find the task simple within excellent user experience design as it improves user retention and thus should be considered for proper design development.

Step 9: Start Development

This is the point where one tends to kick off coding applications using agile methodologies for iterative progress. It tests each feature from time to time and includes feedback to ensure that the application evolves according to the needs of the users. This requirement involves collaboration of developers with designers to achieve a single product output.

Step 10: Testing of the App

Extensive testing is performed for bugs in the code so that it runs smoothly. The tests should also be done on different devices and platforms to check their compatibility. This ensures a user has a reliable and glitch-free application.

Step 11: Launch and Maintenance

Push the app to the public using platforms such as iOS and Android. Also, equip it with a smart marketing campaign that comes with it. Post-launch, collate user feedback and implement periodic updates that resolve issues and roll out new features for a competitive advantage in the long run.

Ways To Generate Revenue for Applications Like Mint

1. Freemium Model

The freemium model is one of the ways through which users connect to the basic features of any app without paying while charging for the additional premium features. This brings a large number of users onto the app and makes users shift towards paid plans for extra tools and perks as well. It serves the cause of being inclusive while continuing to build that steady stream of income from users who-want a more advanced feature in their accounts.

2. In-App Advertisements

It also brings in revenue for an app with the least interference. Ads can also be aligned to the financial habits and preferences of users, thus making it convenient for targeted marketing; for example, the person finds those advertisements favorable while using the app. Hence there lies the balance between the part that earns revenue and that which delights the user by not letting them compromise in their experience.

3. Subscription Plans

Users pay a monthly stream of fees for features such as advanced analytics, personalized financial advice, or ad-free experience. It creates an easy stream of income, predictable enough for developers to invest in app improvements as well as customer support.

4. Paid application

Upfront revenues can be guaranteed through a “one-time download” of the app. Such applications will work best for applications that have unique features and can guarantee value right off the bat. Although it reduces the initial number of users, it brings in enthusiastic users ready to pay extra for quality.

5. In-App Purchases

Additional advanced functionalities or tools, such as customized financial reports or investment calculators, are sold right within the application. In-app purchases help the users to personalize their experience that thus leads to improved satisfaction, as well as enhances revenue increase. The model goes well with that of freemium.

Also Read: Cost to Develop International Money Transfer App like Remitly

Factors That Decide Personal Finance App Development Cost

1. App Features

These are features you must keep in your app. These app features will define the scope of the app clearly and determine its complexity. Basic features like budgeting, categorizing expenses, and simple reports take less time for app development and are economical. Advanced features like AI-based financial advice, transaction syncing with banks in real-time, and the ability to keep track of investments necessitate a lot of expertise, high development costs, and a higher burden of testing. Gamification and personalized features tend to increase costs and improve engagement.

Estimated Cost: $10,000 – $150,000

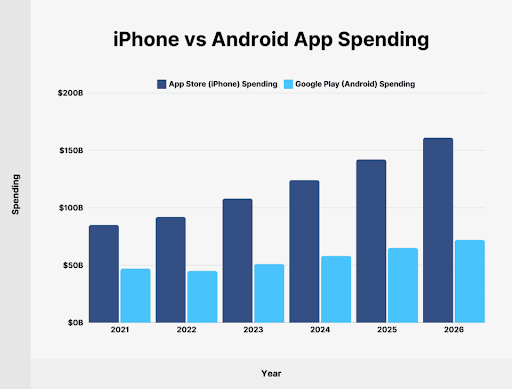

2. Platform (iOS, Android, or Both)

Going with just one platform (iOS or Android) saves on costs compared to developing using both. Native applications provide better performance criteria and features specific to the platform, but those costs are more expensive to build and maintain. Cross-platform platforms like Flutter or React Native provide both worlds- a single codebase for both platforms but sometimes compromise performance.

Estimated Cost: $15,000 – $100,000

3. UI/UX Design

A visually appealing and user-friendly design is the key to personal finance apps, as they have to simplify complex monetary data. Minimalist design with intuitive navigation will be cheaper, while personalized animation, interactive charts, and theme personalization will drive the design cost. In design, user research, wireframes, prototypes, and iteration testing.

Estimated Cost: $5,000 – $50,000

4. Backend Development

The backend infrastructure takes care of data storage, processing, and even integration with third-party APIs. Although using cloud-based services like AWS or Google Cloud makes setting up your backend a lot easier, it comes with the catch of ongoing costs. The custom server setup comes as an add-on cost with advanced features that include things like real-time data synchronization, analytics, and robust security protocols, increasing the initial development and ongoing maintenance costs.

Estimated Cost: $10,000 to $70,000

5. Security and Compliance

The fact that financial applications handle very sensitive information in terms of data makes security a very high priority. Data encryption, servers secured, two-factor authentication, biometric login are some hardware features that supplement security. Compliance with data protection regulations such as GDPR, PCI DSS, or PSD2 would be necessary for legal safety. These features would require additional development, auditing, and certification for practice or installation.

Estimated Cost: $10,000 – $60,000

6. Integrating Third-Party Services

Personal finance applications usually integrate with banking APIs, credit card systems, and payment gateways to provide real-time information and transaction processing. Licensing fees for APIs are often found alongside the stagnation of required periodic updating. Complex integrations such as that of open banking services or global payment systems take extended time to build and thus cost significantly more, but they are more functional.

Estimated Cost: $5000- $40000

7. Development Team Location and Expertise

Geographical location influences the developer rate. North American and Western European developers charge $100–$200/hour whereas Eastern European, South Asian, or Southeast Asian developers charge $30–$60/hour. There is also a difference in expertise, costly experienced developers or specialists in niche domains deliver high-quality work and reduce future risks and upkeep costs.

Estimated Cost: $15,000 – $200,000

8. Application Testing and Quality Assurance Services

An application is thoroughly tested before it can be expected to work on various devices and under different conditions, whether involving functional, performance, security, or usability criteria. Finding bugs and optimizing user experience involve automated testing tools as well as manual testing. The more complex an application is because of various integrations, the more extensive is this application-testing work, and hence costs increase.

Estimated Cost: $5,000 – $30,000

9. Upkeep and Enhancement after Launch

Launching an app is the beginning. Updates for bug fixes, new feature introductions, and keeping up with the latest operating system upgrades have to be regular. Maintenance would include server fees, monitoring for security threats, and adapting to user feedback. More resource-intensive are apps with a larger user base or complicated backend.

Estimated Cost: $2,000 – $15,000/year

Here is an estimated personal finance app development cost:

| Feature/Aspect | Basic Version | Advanced Version | Enterprise Version |

| App Complexity | $10,000–$20,000 | $20,000–$50,000 | $100,000+ |

| Platform | $5,000–$10,000 | $15,000–$30,000 | $50,000+ |

| UI/UX Design | $3,000–$7,000 | $10,000–$20,000 | $30,000+ |

| Backend Development | $5,000–$15,000 | $25,000–$50,000 | $100,000+ |

| Third-party Integrations | $2,000–$5,000 | $10,000–$20,000 | $50,000+ |

| Security Features | $3,000–$5,000 | $10,000–$20,000 | $30,000+ |

| Total Estimated Cost | $20,000–$50,000 | $50,000–$150,000 | $200,000+ |

Why Choose iWebservices to Get Your Next Fintech App?

Now, you know how much a personal finance app development cost, you must be thinking about how to choose the best development partner. iWebservices is a leading AI app development company with over 12 years of experience in delivering advanced web and mobile apps.

With a team of well-versed developers, customer-centricity, and cost-effective solutions, we ensure you have a feature-rich app that is secure, scalable, and user-friendly. Let us bring your fintech application idea to reality in an efficient, affordable way!

Final Thoughts

That brings us to the end of this blog. We hope now you know everything about personal finance app development cost. It’s crucial to note the final price depends on several factors as discussed. Also, you need a trusted fintech app development company like iWebservices to get a feature-rich app within your budget. We have a team of top programmers with required expertise and skills. So, what are you waiting for? Start your next finance app project today.

FAQs

Q1. What are the popular finance apps as of 2025?

Based on usability and functionality, some of the top finance apps include Mint for budgeting, YNAB for individual budgeting, PocketGuard for managing expenses, Robinhood for investing, and Revolut for banking and currency exchange.

Q2. How to reduce fintech app development cost?

Focus on MVP, cross-platform tools usage, pre-built APIs integration, outsource to cheap areas, and iterative development to reduce wasteful resources and expenses. Efficient planning saves on the costs.

Q3. How long does it take to build a personal finance application?

Simple apps take 3 to 6 months, mid-range apps take 6 to 12 months, and very sophisticated apps with advanced capabilities may take 12 months to develop. Time frames depend on the app’s scope.