ISerg

Tech stocks have had an amazing run over the past 12+ months, but recent earnings and share price performance of Nvidia (NVDA) suggest that plenty of growth has already been priced in and that the growth party may be coming to an end.

In fact, market strategist Tom Lee recently indicated the potential for a +7% percentage fall in the overall market over the next couple of months. Despite the potential gloomy outlook for stocks, it’s important to keep in mind that it’s a market for stocks rather than the stock market.

This is reflected by the rally in high dividend stocks like Altria (MO) and Philip Morris International (PM) over in recent months while many high flying tech stocks have traded sideways, as the market has gravitated toward income stocks.

As such, dividend stocks could actually catch a bid while the overall market could see a decline, due to outsized sway that some mega-cap tech stocks have over the market.

This brings me to Ladder Capital (NYSE:LADR), which I last covered in August of 2023, noting its robust return on equity and strong balance sheet relative to peers with plenty of dry powder. The stock has done well for investors, giving a 26% total return since my last piece, surpassing the 23% rise in the S&P 500 (SPY) over the same timeframe.

In this article, I revisit LADR including recent business performance and discuss what makes it a continued appealing stock to own amidst a frothy market, so let’s get started!

LADR: 7.5% Yield, 135% Dividend Coverage

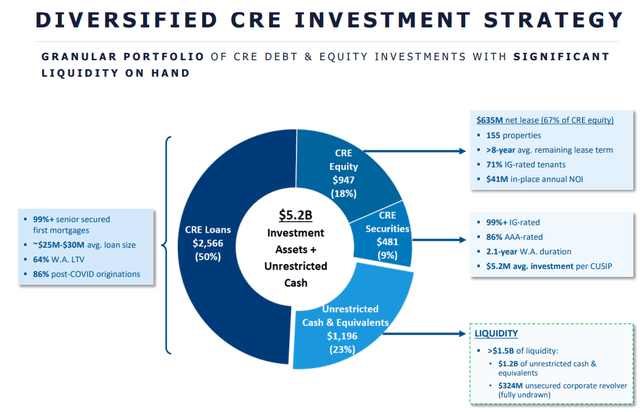

Ladder Capital (LADR) is a commercial mortgage REIT that has a diversified investment portfolio with $5.2 billion. Commercial loans make up just 50% of the total portfolio and physical real estate, CRE securities, and unrestricted cash and equivalents comprise the rest.

LADR’s non-commercial loan assets include multifamily, dollar stores, and grocery stores, among others, with a carrying value of $719 million, as well as a securities portfolio that’s 86% comprised of AAA-rated loans and 99% are investment grade rated.

As shown below, LADR carries plenty of dry powder with $1.2 billion worth of cash and equivalents representing 23% of the total portfolio.

LADR adopts a conservative approach when it comes to investing in commercial loans, with 99% of this segment being invested in senior secured first mortgages, with a weighted average loan to value of 64%, ensuring that borrowers have plenty of equity cushion. Moreover, 86% of its commercial loans were originated post-COVID, making its portfolio strategy a reflection of the current real estate and macroeconomic landscape.

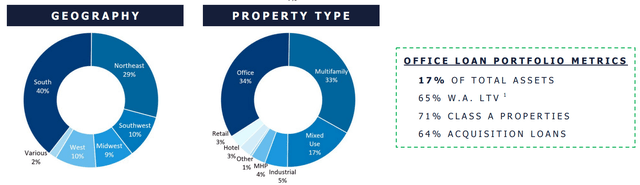

LADR’s portfolio is diversified by geography and property type, with office and multifamily making up the the two top sectors at 34% and 33% of the loan portfolio, respectively. While office loans may give some investors pause due to headline risks around this asset class, it’s worth noting that 71% of LADR’s office loan collateral is comprised of high quality Class A properties.

Meanwhile, LADR continues to demonstrate strong performance, with a 10.5% return on adjusted equity for Q2 2024, sitting at the same level as the prior year period. LADR also netted distributable EPS of $0.31, which equates to a robust 1.35x dividend coverage ratio over the $0.23 quarterly dividend rate.

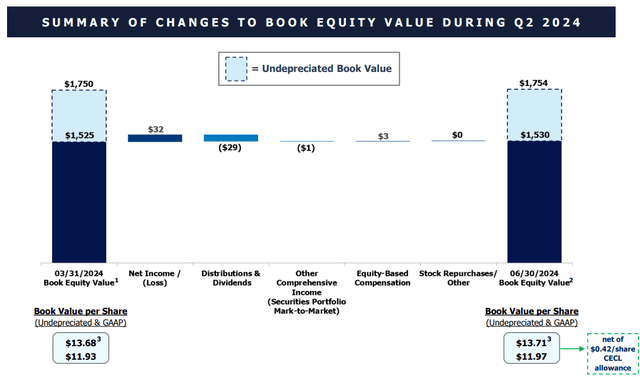

Also encouraging, LADR was able to grow book value both on a total and per share basis, driven in large part by out-earning its dividend payout. As shown below, undepreciated book value per share grew by $0.03 on a sequential basis to $13.71.

LADR also maintains a strong balance sheet with an adjusted debt to equity ratio of 1.4x as of Q2, down sequentially from 1.7x in the prior quarter. This compares favorably to that of peers Starwood Property Trust (STWD) and Blackstone Mortgage Trust (BXMT), which carry leverage ratios of +2x and +3x, respectively. LADR also has $1.5 billion in total liquidity, enabling it to take advantage of opportunities where they may arise.

Risks to LADR include macroeconomic risks as it relates to commercial real estate, as corporate restructurings could lead to less need for office space. LADR raised its CECL reserve from $25 million in the same period last year to $54 million as of Q2 this year. This equate to $0.41 per share, which is already excluded from the aforementioned $13.71 undepreciated book value per share.

It’s worth noting that borrower defaults don’t necessarily translate into losses due to LADR’s favorable positioning on the capital stack in its investments. This was reflected by the sale of 3 assets that were in default in the first half of this year at a gain above its cost basis. Moreover, there were no significant impairments in its portfolio during the most recent quarter.

Lastly, I find LADR to be appealing at the current price of $12.31 with a 7.5% yield, which is well-protected by a 135% dividend coverage ratio. It also trades at an appealing 10% discount to undepreciated book value of $13.71. LADR’s management is well-aligned with shareholders with executives and directors owning 11% of the company. This, combined with LADR’s strong performance, liquidity profile, and high and well-covered dividend makes LADR an attractive income stock.

Investor Takeaway

Ladder Capital is an attractive high income stock, offering a well-covered 7.5% dividend yield and trading at a 10% discount to its undepreciated book value. The company’s conservative approach to commercial lending, strong liquidity with $1.2 billion in cash and equivalents, and prudent management of its diversified portfolio, position it well amidst broader market uncertainties. With robust financial performance and discounted price, LADR offers good mix of income and value.