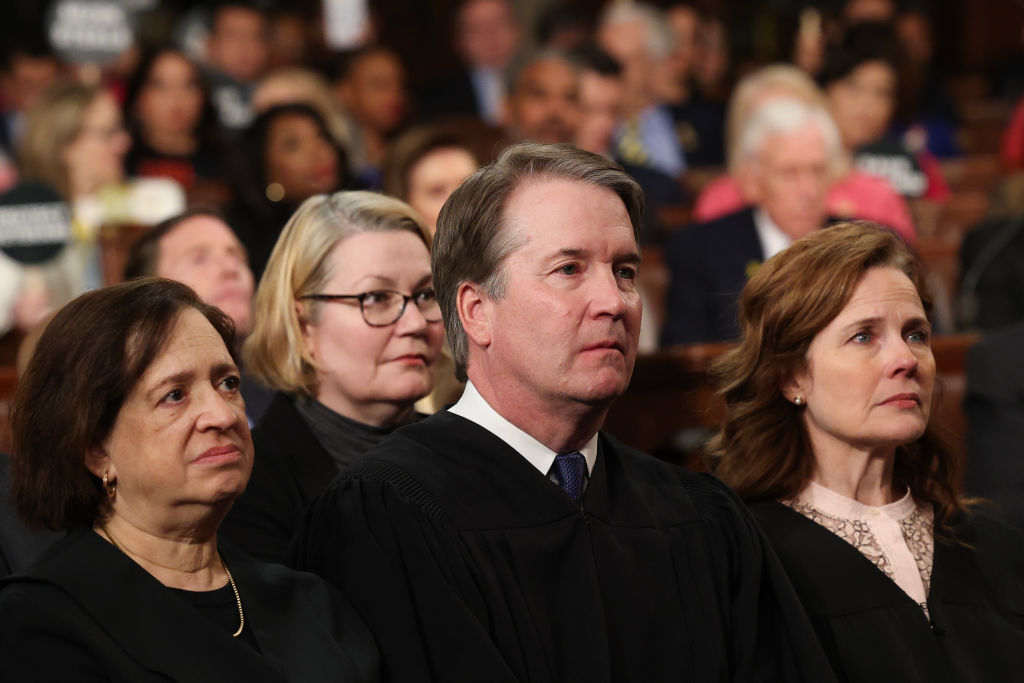

The Supreme Court made clear on Friday that President Donald Trump lacks the legal authority to use his emergency powers to force U.S. companies to pay tariffs. In its 6-3 decision, the court delivered a massive setback to the White House but, in a surprise to legal observers, it failed to address the question that is top of mind for many firms: Will they be able to recoup the money, estimated at around $133 billion, they have already paid under a policy that has now been ruled illegal? According to trade lawyers, the Supreme Court majority’s silence on the refund process—which dissenting Justices Brett Kavanaugh predicted is likely to be “a mess”—means companies must now wait months to learn whether they will get their money back.

In the court’s long-awaiting decision, Chief Justice John Roberts ruled that Trump could not impose emergency levies—like the ones that imposed 25% duties on Canada and Mexico—since the tariffs amounted to a sort of tax that only Congress had the power to impose. This upheld the rulings of lower courts, which found the tariffs to be illegal, but allowed them to stay in place until the Supreme Court weighed in on the matter.

According to Jeff Harvey, a Texas-based trade lawyer at Bradley, the court’s silence on the refund issue was unexpected since it had come up explicitly at oral arguments—where Justice Amy Coney Barrett first referred to the potential for a “mess”—and in lower court proceedings.

“I was surprised since it was something previously raised by the Court of International Trade,” said Harvey, referring to the court whose initial ruling the Trump Administration challenged.

The upshot is that the refund issue is poised to return to the International Trade Court, where the outcome is far from clear. According to Harvey, government lawyers initially suggested to the court that the White House would not object to companies being able to collect a full refund. Since then, however, figures in the Administration have signaled they may change their position—not least because repaying the full amount of the tariffs would be a massive blow to the Treasury.

Harvey added that, if the trade court orders the U.S. Customs and Border Agency to repay the tariffs, the Trump Administration could challenge that ruling, setting off another potential legal battle that could end up back Supreme Court.

The upshot is that companies will very likely have to wait months to get any refund. Worse, trade lawyers say the Customs agency is expected to keep collecting the emergency tariffs for the coming days or weeks since the President’s Executive Order will remain in force until the trade court issues a formal injunction to stop it—a process that could take weeks and that could also be subject to additional challenges from the White House.

When the dust finally settles, though, some companies—notably Costco—could be better poised than others to collect any refunds owed.

Costco’s early challenge may pay off

The process of tariff collection is an arcane one and involves companies paying a preliminary amount based on current import duties that are set out in guidelines updated by the White House. But given that many imported goods contain parts from more than one country, it is not always clear how much a company must pay. Meanwhile, President Trump’s rapidly shifting tariff rates mean a company may pay too much or too little on a given shipment.

In light of these uncertainties, there is a 310 day period during which the U.S. Customs agency can adjust the amounts owed or declare the amount to be final. Typically, Customs needs much less than the maximum allotted time and then prepares to “liquidate” the balance collected. Once the agency is poised to liquidate, however, companies have a 180 appeal period to challenge the final amount it has imposed.

All of this led Costco to file a preliminary lawsuit in December, asking the court to preserve its rights to a refund in the event the Supreme Court ruled the tariffs illegal, and before Customs could liquidate the amount it had already collected.

According to Lizbeth Levinson, an attorney with Fox Rothschild, this is a savvy strategy on the part of Costco, and one that has since been imitated by over 1000 other companies. Levinson says Costco’s petition means that it will allow the company to stop Customs from declaring it cannot pay part of a refund on the grounds the funds in question have been already liquidated.

According to Levinson and other trade lawyers, there is a very real possibility that Customs will seek to avoid full repayment of the wrongfully-collected tariffs, in part because of pressure from the White House, which is concerned that such a move could be a fiscal catastrophe.

Meanwhile, even as lawyers scramble to determine the refund process for the emergency tariffs, which the White House imposed under a law known as the International Emergency Economic Powers Act (IEEPA), companies’ tariff headaches are far from over. President Trump has for months signaled that, in the event of an adverse Supreme Court ruling, he would seek to re-impose the tariffs under other laws, though as lawyers have noted, the process for doing so is slower. On Friday, in response to the court’s decision, Trump declared he would impose a new 10% “global tariff” while saying the Justices who wrote the majority ruling should be “ashamed.”