Trump’s One Big Beautiful Bill Act was signed into law on July 4, 2025. It’s so big that many significant features have been little discussed. Trump Accounts are one such feature under which every newborn citizen gets $1000 invested in the stock market. These accounts could radically change social welfare in the United States and be one important step on the way to a UBI or UBWealth. Here are some details:

- Government Contribution: A one-time $1,000 contribution per eligible child, invested in a low-cost, diversified U.S. stock index fund.

- Eligibility: U.S. citizen children born between January 1, 2025, and December 31, 2028 (with a valid Social Security number and at least one parent with a valid Social Security number).

- Employer Contributions: Employers can contribute up to $2,500 annually per employee’s child, and these contributions are excluded from the employee’s gross income for tax purposes. These are subject to the overall $5,000 annual contribution limit (indexed for inflation) per child (which includes parental contributions).

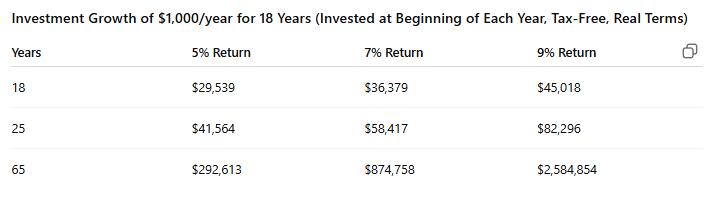

The employer contribution strikes me as important. Suppose that in addition to the initial $1000 government payment that on average $1000 is added per year for 18 years (by a combination of parent and parent employer contributions). Note that this is below the maximum allowed annual contribution of $5000. At a historically reasonable 7% real rate of return these accounts will be worth ~36k at age 18 (when the money can be fully withdrawn), $58k at age 25 and $875k at age 65 subject to uncertainty of course as indicated below.

The $1000 initial payment is available only for newborns but, as I read the text, the parent and employer donations can be made for any child under the age of 18 so this is basically an IRA for children. It’s slightly complicated because if the child or parents put after-tax money into the account that is not taxed at withdrawal (you get your basis back) but everything else is taxed on withdrawal as ordinary income like an IRA. There are approximately 3.5 million citizen births a year so the program will have direct costs of $3.5 billion plus indirect costs from reduced taxes due to the tax-free yearly contribution allowance, which as noted could be quite large as it can go to any child. Thus the program could be quite expensive. On the other hand, it’s clear that the accounts could reduce reliance on social security if held for long periods of time. The $1000 initial contribution is limited to four years but once 14 million kids get them, the demand will be to make them permanent.

The post Trump Accounts are a Big Deal appeared first on Marginal REVOLUTION.