A crash course in biotech success — and failure

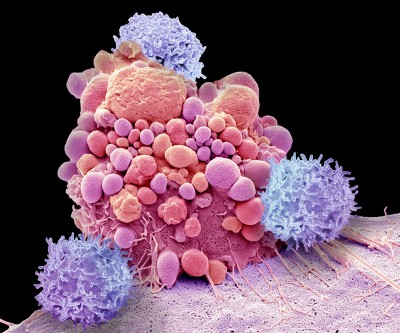

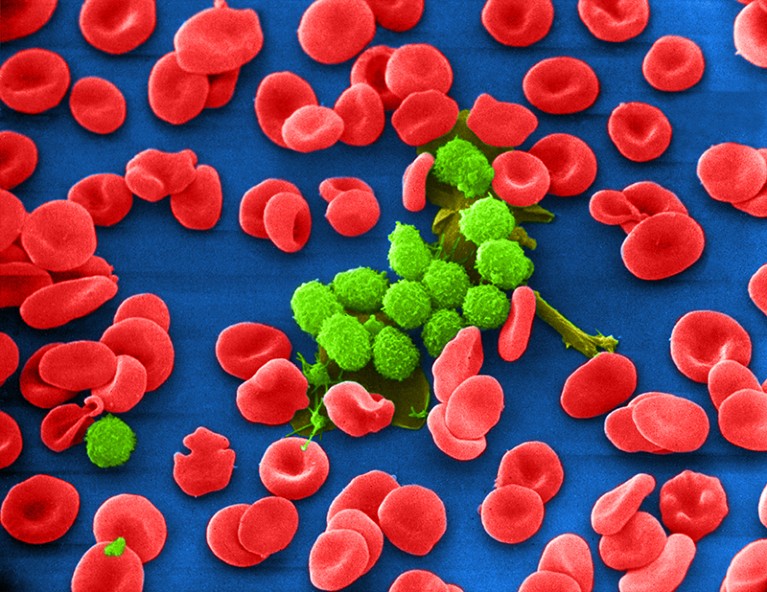

The cancer drug ibrutinib curbs the uncontrolled proliferation of B cells (green).Credit: Keith R. Porter/SPL

For Blood and Money: Billionaires, Biotech, and the Quest for a Blockbuster Drug Nathan Vardi W. W. Norton (2023)

Even in the most experienced hands, the vast majority of candidate drugs fail. So it hardly seems a recipe for success when a serial entrepreneur whose previous business highlights include investments in needlepoint kits and bakeries takes over a struggling biotechnology firm.

Improbably, it was. Although Robert Duggan did not achieve his initial goal of developing a treatment for brain cancer, the disease that claimed his son’s life, his company went on to produce a transformative leukaemia drug called ibrutinib, and Duggan became a billionaire. Yet, despite the financial happy ending, the story that veteran business reporter Nathan Vardi tells in For Blood and Money is no fairy tale. The book is an engaging tutorial on the harsh realities of drug development, including a warts-and-all look at the outsize role of chance and money — and how science often ends up taking a back seat to finance.

Last-resort cancer therapy holds back disease for more than a decade

Duggan took over Pharmacyclics in 2008 when the company, based in Sunnyvale, California, seemed to be on its last legs. It had just weathered a series of bruising clinical-trial results that spelled the end for its most promising prospective treatment, a drug intended to shrink brain tumours that not only failed to do that, but also sometimes turned trial participants’ skin green.

Potential for success

Years earlier, Pharmacyclics had happened to buy a few bargain-priced assets from another company, including a compound that binds to and inhibits a protein called Bruton’s tyrosine kinase. The compound was originally meant to be a research tool, not a medicine. In the wake of the failed brain cancer trials, however, Pharmacyclics decided to put the inhibitor into play. It reasoned that, because the kinase was important for immune cells called B cells, blocking the protein could be a way to quench cancers that are caused by uncontrolled B-cell proliferation, such as some forms of lymphoma and leukaemia.

Staff members at Pharmacyclics worked around the clock to test the compound amid a whirl of company politics and pressure from early investors. Word got out of Duggan’s eccentric leadership style — heavily influenced by his faith in Scientology, hard-driving personality and experience in consumer-oriented industries with less regulation than for biotech firms such as Pharmacyclics. “Those who had heard of it, through the Silicon Valley biotechnology grapevine, knew it to be a weird place,” Vardi writes.

A bitter pill

Even so, much of Pharmacyclics’ broader story is a common biotech parable. Academic scientists with an interest in drug development will benefit from the reality check. Science was just one of many factors that determined ibrutinib’s fate, among them money, competition, intellectual-property law, regulatory requirements and health-care economics. Researchers often did not pull the strings — in fact, few were still around to reap the rewards when the cash came rolling in. The puppeteers were the investors who were willing to put their money on the line and who had little-to-no formal training in science.

Why children have to wait years for new drugs

Vardi spends much of the book detailing how Wayne Rothbaum, a savvy micromanaging stock trader and early investor in Pharmacyclics, influences the company’s direction, including key scientific decisions. Tensions rise and Duggan fires a few key executives who had worked around the clock on the drug and has them escorted out of the building. A few weeks later, Vardi says, one borrows a friend’s credentials to sneak into a Pharmacyclics presentation at a prominent oncology conference. She sits in the audience, weeping as she learns that the clinical trial she had helped to design was a success.

And a success it was: ibrutinib slowed cancer growth in two-thirds of people with chronic lymphocytic leukaemia, the most common form of cancer in adults, and it did so with fewer toxic side effects than standard chemotherapy. Vardi describes a participant who woke up one morning to find that his cancer-swollen lymph nodes had shrunk and the constant pain they caused him was gone. His first thought was that he must have died. Another participant travels with his full supply of ibrutinib in his pockets, worried that an emergency might separate him from his bags.

Ultimately, Pharmacyclics reached the climax that awaits many successful biotech companies: being bought out by a larger pharmaceutical firm that has the cash and infrastructure needed to mass-produce and sell a drug while complying with regulatory requirements. In 2015, AbbVie in North Chicago, Illinois, acquired Pharmacyclics for US$21 billion. The hard work of a select few company employees was rewarded with millions of dollars; the investors who took on a financial risk to bankroll the operation got billions. Some of the scientists and executives at Pharmacyclics were bitter over the magnitude of this difference, and Vardi highlights the people who were left out of completely, including the academic researchers who ran the clinical trials and the scientists who first designed ibrutinib.

Could CAR-T-cell therapy offer hope to children with cancer?

But readers outside the biotech bubble might reserve their anger for another aspect of the story. When ibrutinib hit the market in 2013, a course cost $131,000 per year in the United States. Some people need to take the drug for years. Ibrutinib might be less physically toxic than various other cancer treatments, but it is financially toxic for many of the people who need it.

For Blood and Money does an excellent job of highlighting the complexities and expense, both financial and personal, of drug development. But, given that more than 40% of people with cancer in the United States have burnt through their life savings within two years of diagnosis, the giant payouts at the end are perhaps the bitterest pills to swallow.

Competing Interests

The author declares no competing interests.